Foreword:

Banking in China is as simple or difficult as in any country, but combine it with the difficulty of dealing with the local language and customs it is often more difficult for the first timer. This guide aims to help you guide through the process of first opening a bank account and some additional banking items that you may need every day.

What banks are there?

The major banks in China are:

BOC - Bank of China

(ZhongGuo YinHang - 中国银行)

ICBC - Industrial and Commercial Bank of China

(GongShang YinHang - 工商银行)

CMB - China Merchant Bank

(Zhao Shan YinHang - 招商银行)

ABC - Agricultural Bank of China

(NongYe YinHang - 农业银行)

CCB - China Construction Bank

(JianShe YinHang - 建设银行)

COMM - Bank of Communications

(JiaoTong YinHang - 交通银行)

We strongly recommend opening only at one of these banks. Not only do they most likely have the most numbers of ATMs in the city, they are also more likely to have some English speaking staff in their central located branches.

How to open a bank account

Checklist:

- Passport

- Local Address

- Local phone number

For a normal account using Renminbi RMB (Chinese Yuan) you can setup your account generally with just 10-15 RMB for the card cost which varies from bank to bank as some may use IC chips and some do not.

General opening hours are 9:00 - 17:00. However banks have varying opening hours and opening days depending on the branch, which may also depend on the size and location of the branch. Some branches open even on holidays and some close at 16:30 whilst some close at 17:30 or even 18:00. These factors may influence you on which one to choose. The opening times of a branch will be always clearly posted at the entrance of every bank.

Banks that have a green currency exchange sign at their door will offer foreign currency exchange, however if your planning to exchange your RMB into anything outside of US dollars often will require you to book an additional meeting, so that the bank can prepare the correct currency you require. Generally they accept most currencies on the spot to change into RMB. Again more centralized located branches will be more convenient to deal with this.

If you travel a lot outside of major first tier cities (SH, BJ, GZ, SZ)BOC is probably your best choice as they have a lot of ATM machines even in smaller cities. In Shanghai particularly, ICBC has a lot of branches almost everywhere, but most are concentrated in Jing An, Xu Hui and Huang Pu. Also the major banks, especially those located in a central location, will often have some personnel who can speak at least basic English.

If you choose a bank with not a lot of ATMs and you withdraw using another bank’s ATM, you will be expected to pay 2 RMB per transaction in the same city where you opened your card at and around 5-30 RMB in other cities, even if it is the same branch.

Your choice of bank may also depend what your employer uses or even your landlord, as cross-bank transfer is rarely used in China and if you have not much Chinese skills, the easiest way is to just transfer the money in the ATM machine of the bank you want to deposit to. Increasingly of use are now Wechat transfer and Alipay money transfers which we will cover here.

Pro Tip: Choose the branch where you first set up your bank account wisely, as any big changes or modification to your bank account requires you to return to this particular branch. Also most employers will need you to state this bank’s address when they transfer you your salary.

The process:

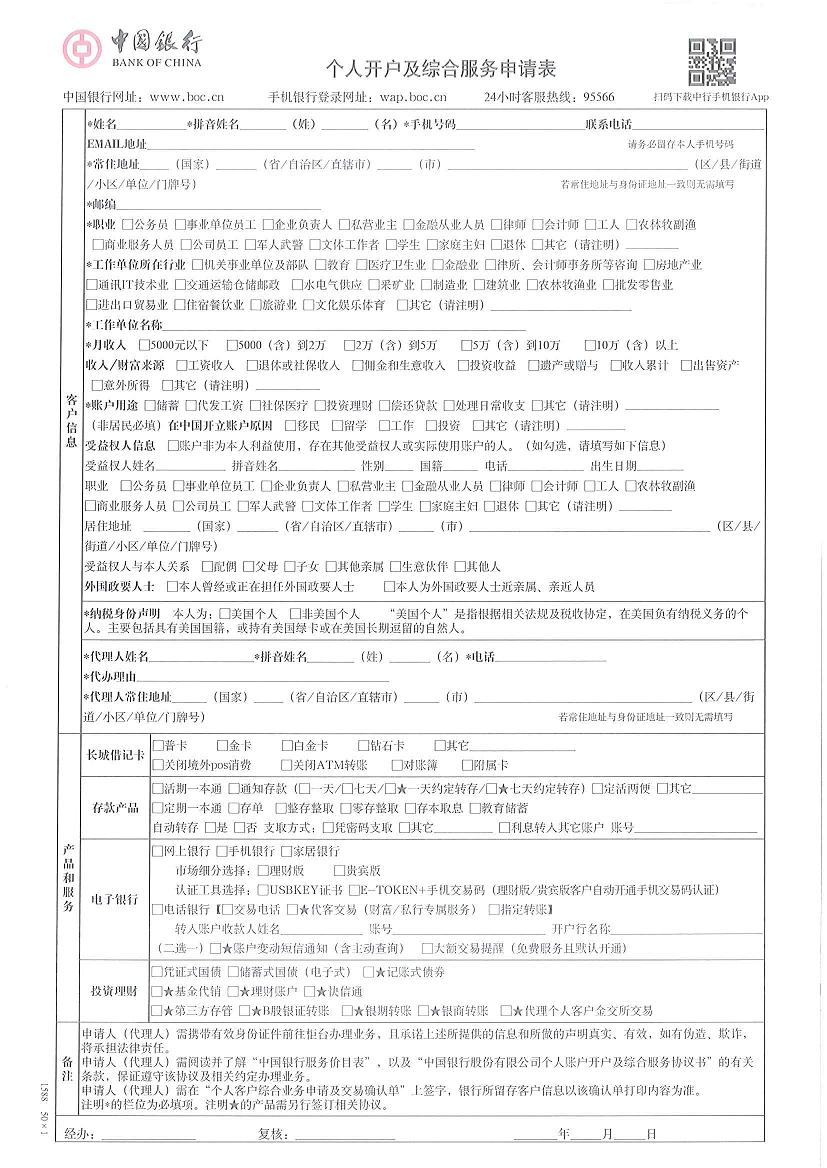

When you first enter your chosen bank, simply head to the front desk counter and ask them that you want to open a personal bank account (kai zhang hu开个人帐户). They will give you a 个人客户资料登记表 (Personal information registration form) to fill out such as this:

At the same time grab a queue ticket, as most banks have a queue and depending on what time you visit the branch, you may fill your form and still have to wait a long time before it is your turn.

As of 2016 only ICBC offers the this form in both English and Chinese, however all the major banks offer English service through their telephone hotlines. None of them offer yet English version mobile applications.

Once at the counter they will let you sign some papers, scan your passport and insert your PIN (6 digits) and your done.

Pro Tip: To avoid big queues at the banks, avoid early mornings as the Chinese elderly people like to do queue during this time, sometimes even waiting in front of the bank before it even opens. Generally 16:00 to 17:00 are the best times, however some banks close at 16:30, whilst some close at 17:00 so be informed in advance. The best time is towards the end of the working day as there will be fewer people, but also the banking staff will stop taking on any new customers and will work harder on the remaining ones to finish on time.

Pro Tip: Keep the papers they give you when you first opened your account, as it has a lot of information such as bank account name (the way the bank input in your name is important for future transaction as they sometimes mix up your middles names which are common in foreigners), the branch address (often needed for your company’s HR) and it is useful to show if you have lost your bank card accidentally.

Pro Tip: Ensure that your name is the same as your passport, so if you have a lot of middle names make sure they use the correct sequence, as this will affect on whether you will get any incoming transfers to your account, opening a Wechat wallet and various other banking needs.

Pro Tip: Ask the bank to send you a SMS notification every time you pay, receive or deposit any amount of money. This service generally costs 2 RMB per month and is totally worth it for budget planning and fraud prevention.

Other services for your account:

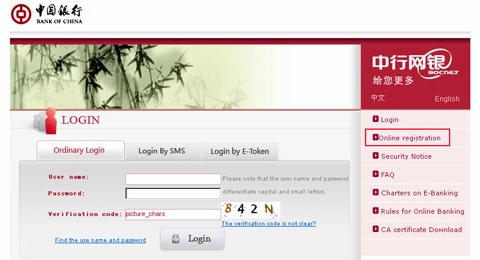

- Open online banking services (you can check and manage your savings online or using the banks APP). The APP is the easiest as using your computer requires you to use the USB they give you if you decide to open online services and install their cumbersome security software. However the APP is not available yet in English. Most banks now do have an online web version in English however.

- Telephone service (you can check your balance on the phone and transfer as well) for which you have to set up your telephone numerical pin code - it is best to inquire about this when you first sign up at your bank.

- Taobao linking your account sometimes require you to go to your branch, especially if your a foreigner as some of the names do not add up as mentioned above. You can also pay for your Taobao shopping needs using Alipay, which we discuss more in detail here.

On a side-note if you use online banking on your PC, use Internet Explorer as most other browsers generally are not supported.

Lost your bank card?

First phone your bank's hotline:

BOC - 95566

ICBC - 95588

CMB - 95555

ABC - 95599

CCB - 95533

COMM - 95559

They will have an English speaking service, so wait for the right prompt when dialing the hotline.

To replace your card, depending on the bank and branch, you may have to go the branch where you first opened your bank account. Bring your passport and if possible your bank account number, however they can find it out for you if you do not have it. You will be asked what your address is, the PIN code of your card and your phone number. They may ask you to bring a secondary identification with you, such as a driver license.

Do note that it will take most banks seven days to replace your card. During these seven days you will be unable to access your bank account even at the bank teller with your PIN and passport, but you can access it online if you have online banking.

Pro Tip: Nowadays the seven-day rule only applies if you want to keep the same bank account number on your card. You can often get a new card right away if you do not care what bank account number you will get on your new card. Even if you have a different bank account number on your card, the old bank account number on your card will be still linked to you, so there is no real reason to wait seven days anymore.

Pro Tip: If you know you lost your ATM card in an ATM machine (don’t worry it happened to all of us at any one time probably) go to your local branch as they will keep the card for a few days before they will pass your card to the central bank. You will require your passport of course for identification.

Oversea money transfer:

Some of us sometimes send money back to our home countries, be it parents, spouse, estranged spouse or kids. If you transfer without any tax receipts and with a foreign passport you will be limited to $500 (US dollars) per day.

If you want to wire your entire paycheck (only legal tax-deducted paychecks) you can only do that if you come to the bank with tax receipts, employment contract and fill out the appropriate paperwork.

Credit Card:

Nowadays more and more Chinese are using credit cards, especially since they are going overseas, however for foreigners it is a bit more complicated. The exact requirements vary from bank to bank, but generally amounts to:

- You will require several months of paycheck statements from your company (generally a min. of 3 months)

- You will need to deposit a certain amount of money in your bank (which makes the whole concept of credit card kind of useless) or proof of assets.

- Resident permit

- Work permit

Pro tip: If you can meet the requirements for credit cards, try the smaller banks as they often give very good deals to promote their credit cards such as free movie tickets, severely discounted hotels/flights and other various promotions if you use their credit card. Generally the bigger banks do not offer as many incentives and bonuses for using their credit card. Also some smaller banks may have more lenient credit card requirements.

Pro tip: China Merchant Bank seems to be one of the bigger banks with the most lenient Credit Card registration policies. Also sometimes simply asking another staff member in a bank could yield different results as some staffers are known to be simply “lazy” in registering you for the CC, so it may be worth trying at another branch or simply coming back another day to try it again.

Useful Chinese keywords:

密码 - MiMa - Password

地址 - DiZhi - Address

开账户 - KaiZhangHu - Open bank account

护照 - HuZhao - Passport

电话号码 - DianHuaHaoMa - Telephone number

信用卡 - XinYongKa - Credit Card